Choosing between term and whole life insurance in Florida can feel overwhelming, especially with the unique factors affecting Floridians—like hurricane risk, state regulations, and retirement trends.

This guide breaks down the differences and helps you find the right policy for your budget, lifestyle, and future goals.

Before You Start

Before comparing term and whole life insurance, gather the following:

-

Your current financial obligations (e.g., mortgage, dependents)

-

Budget for monthly premiums

-

Long-term financial goals (e.g., retirement, estate planning)

-

Any existing life insurance coverage

-

A list of questions for a local advisor (like Insurance Central of Tampa Bay)

Understanding your needs and options upfront will make choosing a policy far easier.

Step-by-Step

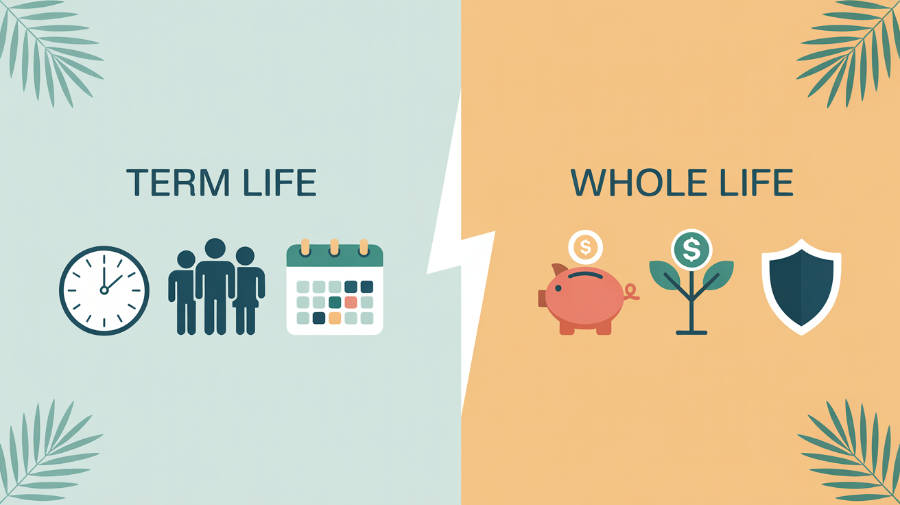

Step 1: Understand the Basics

-

Term Life Insurance: Coverage for a specific period (e.g., 10, 20, 30 years). It’s usually cheaper and ideal for temporary needs.

-

Whole Life Insurance: Permanent coverage with a cash value component that grows over time. Costs more but lasts for life.

Step 2: Consider Florida-Specific Factors

-

Florida’s retirement-friendly status means many residents need policies that extend into later years.

-

Hurricanes and climate risk may affect your premiums or underwriting process.

-

State regulations also impact how insurers operate and what options are available.

Step 3: Evaluate Costs and Benefits

-

Term is more affordable but doesn’t build cash value.

-

Whole life offers long-term financial tools (like borrowing against cash value) but at higher premiums.

-

Ask for quotes from Florida-based insurers to see how local pricing compares.

Step 4: Factor in Your Life Stage

-

Young families: Term life may offer the most value.

-

Near retirement: Whole life can assist with estate planning.

-

Business owners: Consider policies that support buy-sell agreements or succession planning.

Step 5: Talk to a Local Expert

A licensed Florida insurance advisor, like those at Insurance Central Tampa Bay, can help you navigate options and state-specific considerations.

What’s the Real Difference?

The key difference lies in duration and value:

-

Term Life is temporary, pure insurance. When the term ends, so does your coverage—unless you convert or renew.

-

Whole Life is permanent and accumulates cash value, which grows tax-deferred. You can borrow against it or use it for future expenses.

Over time, the financial commitment to whole life insurance may pay off, especially if you stay in good health and maintain the policy. However, term life can be converted later if your needs evolve.

Troubleshooting

Common Mistake #1: Choosing based on price alone

Solution: Consider your long-term financial goals and whether you need lifetime coverage or just protection for key life stages.

Common Mistake #2: Ignoring local risks like hurricanes

Solution: Ask how Florida’s climate may affect premiums or underwriting.

Common Mistake #3: Skipping the medical exam to save time

Solution: While convenient, no-exam policies may be more expensive or offer less coverage. Weigh the trade-offs.

Conclusion

Term and whole life insurance serve different purposes—term is budget-friendly and time-limited, while whole life is a lifelong financial tool. For Florida residents, local factors like weather risks, retirement planning, and state laws add extra layers to consider. Consulting a local expert like Insurance Central of Tampa Bay ensures your policy fits both your life and location.

Need guidance? Contact Insurance Central Tampa Bay for personalized advice.