Living in Tampa Bay means sunny days, great beaches, and yes—hurricane season. Every year, storms sweep across Florida and leave behind billions in damages. While you can’t control the weather, you can control how prepared you are. Insurance is one of the smartest tools you have to protect your home, car, and family when the winds start picking up.

Why Hurricane Prep Matters in Tampa Bay

Florida ranks at the top for hurricane risk, and Tampa Bay homeowners know how quickly a tropical storm can turn into a major disaster. Having the right insurance in place isn’t just about peace of mind, it’s about making sure you can recover quickly if your home or belongings are damaged. A strong insurance strategy can mean the difference between rebuilding smoothly and facing overwhelming costs.

If you’re a homeowner and haven’t reviewed your coverage recently, now’s the time. Check out options like homeowners insurance in Tampa to make sure your policy is current.

What Insurance Policies Protect Against Hurricane Damage?

Homeowners Insurance

This policy usually covers wind damage, but it may have exclusions or high deductibles for hurricanes. Don’t assume you’re fully protected—read the fine print.

Flood Insurance

Most homeowners don’t realize that storm surge and flooding aren’t covered under standard homeowners insurance. In a place like Tampa Bay, where flooding is a constant risk, a separate flood insurance policy is a must-have.

Mobile Home Coverage

Florida has a large number of mobile homes, and they’re especially vulnerable to high winds. If you own one, make sure your mobile home insurance policy specifically addresses storm protection.

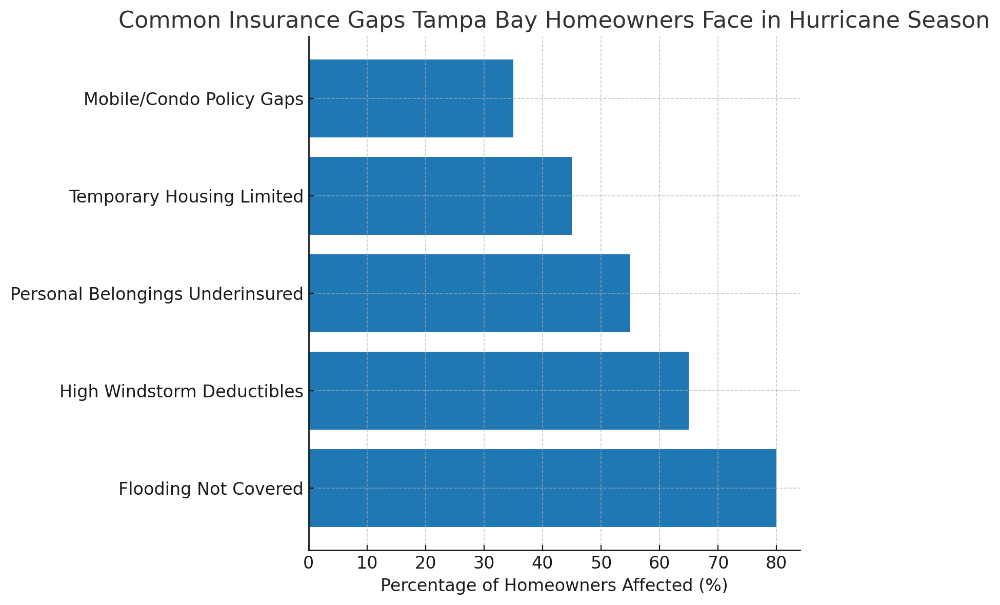

Common Gaps Homeowners Overlook

Even if you have coverage, there are often gaps that can surprise you after a storm:

-

Windstorm Deductibles: Some policies carry a separate, higher deductible for hurricane or wind damage.

-

Temporary Housing: If your home becomes unlivable, will your insurance cover hotel stays or rentals?

-

Belongings: Coverage limits might not fully replace electronics, furniture, or valuables.

If you own a condo, policies can be especially tricky. A condo insurance plan in Tampa can help bridge the gap between what your condo association covers and what you’re responsible for.

Smart Steps to Prep Before the Storm Hits

Insurance is critical, but preparation goes hand in hand. A few things to do before hurricane season ramps up:

-

Document Everything: Take photos and videos of your belongings and store them in a safe digital folder.

-

Review and Update Policies: Small changes, like home upgrades, can affect your coverage needs.

-

Secure Copies of Policies: Keep both digital and paper copies in case the power goes out.

Need a quick way to compare policies? Start with this page to get the best home insurance quote in Tampa.

Quick Recovery Tips After a Storm

The storm may pass in a few hours, but recovery can take weeks. Here are some steps that speed up the process:

-

File Claims Quickly: Insurance companies often work on a first-come basis after major storms.

-

Keep Repair Receipts: Whether it’s temporary tarps, boarding windows, or food costs, receipts help with reimbursements.

-

Check Vehicle Coverage: Hurricanes don’t just damage homes. Make sure your auto insurance in Tampa protects you against storm-related damage.

FAQ – Tampa Hurricane Insurance Questions

Does regular homeowners insurance cover hurricane flooding?

No. Flooding from storm surge or heavy rains is only covered with a separate flood insurance policy.

Is flood insurance required in Tampa?

If you’re in a FEMA-designated flood zone, your lender may require it. Even if it’s not mandatory, it’s strongly recommended.

Can renters get hurricane protection?

Yes. Renters insurance in Tampa can cover personal belongings damaged in a storm, but like homeowners insurance, it usually won’t cover flooding without a separate policy.

Last Words

Preparing for hurricane season isn’t just about boarding up windows or stocking up on water—it’s about making sure your insurance actually works when you need it. Review your policies, fill in the gaps, and talk to a local insurance expert before the next big storm rolls in.

And while you’re thinking about protection, remember that storm prep goes beyond your home. Your health and retirement coverage matter too. Resources like Medicare Info Pro can help you understand your healthcare options in Florida, so you’re covered on all fronts.